An alternative payment model (APM) is a payment model that compensates a provider for delivering high-quality yet cost-efficient care. The Department of Health and Human Services (HHS) is working in conjunction with healthcare providers in the public, non-profit, and private sectors to renovate the U.S. healthcare system, while highlighting value over volume. Alternative Payment Methods require fundamental changes in routine operations to improve quality and reduce cost. Delivering better care at a lower cost is a path to success for physicians, customers, and others in the healthcare system. Implementing operational changes will be worthwhile and appealing only if the majority of payers embraces new APMs and payment reforms. When healthcare providers encounter new payment strategies for one payer but not others, the incentive to change is weak. When payers align their efforts, the incentive to change is stronger, and the obstacles to change are reduced.

The types of APMs as defined under the Quality Payment Program include Physician-Focused Payment Model (PFPM) and Advanced Alternative Payment Model (Advanced APM). PFPM can be categorized as an APM or an Advanced APM. Providers and other qualified clinicians are very important in executing the payment method. PFPM pursues healthcare quality and the cost of service that physicians or other eligible clinicians provide. On the other hand, the Advanced Alternative Payment Methods require participants to implement an electronic health record (EHR) technology. Payments for qualified services are based on quality measures and can be compared to MIPS quality measures.

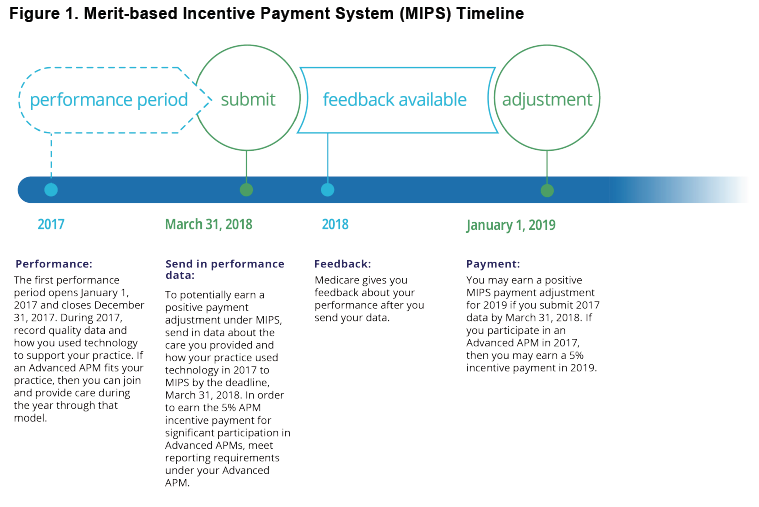

The timeline for implementing APMs usually takes the Centers for Medicare & Medicaid Services (CMS) 18 months to employ. APMs may take longer to develop if they require changes to the Medicare payment processing system, because those changes typically can take 9-12 months; are unusual and require big change; include payment policy waivers or fraud and abuse waivers; or CMS may need to coordinate with payers and enter into legal agreements with those consumers, or give them time to prepare for participating, including time for payers to connect with participants; health care providers about taking part in the model test.

Besides these factors, there are specific requirements in planning for Alternative Payment Method testing. CMS requires time to implement applications, communicate with eligible consumers, complete forms, review applications and prepare participation agreements for entities to sign. Organizations need time to review these participation agreements and to begin planning for participation in the model. Also, APMs require contract support, and the model development timeline has to include the time needed for bidding and awarding contracts for these support services.

The announcement by CMS and HHS fast-tracks the movement away from Fee for Service (FFS) providing more transparency for the process of physicians to accept risk with new reimbursement procedures. Physicians must continue to evaluate future care-delivery models emphasizing value-based reimbursement. It also requires considering long-term investment needs in infrastructure, reporting capabilities, education, and leadership to meet the new expectation of patient-centered, high-quality, affordable care. Eligible clinicians may qualify for bonuses under the Quality Payment Program through significant participation in Advanced APMs or Merit-based Incentive Payment System (MIPS).

Shared-Savings is an APM in Healthcare that offers incentives for physicians while reducing spending for a particular patient demographic by providing them a percent of savings recognized as a result of their efforts. In 2012 began the creation of the Medicare Shared-Savings Program for Accountable Care Organizations (ACOs), which called for shared savings as a primary payment method. ACOs have since taken steps to negotiate and implement Shared-Savings contracts with commercial insurers. Services that are included in the Shared-Savings calculations are relative to covered services for the patient population. In some cases, services are excluded due to self-insured employers carving out services to a specialty vendor.

Shared-Risk methods are arrangements between the patient and provider to share the financial risk since patients end up paying for procedures that are not covered by insurance. Sharing the risk with the patient creates a savings model where the savings will drive innovation. Accountable care is an overview of the healthcare system funneled into one carefully integrated delivery process, focused on outcomes, not treatments. In the Accountable Care model, the emphasis will move from paying for volume to paying for value.

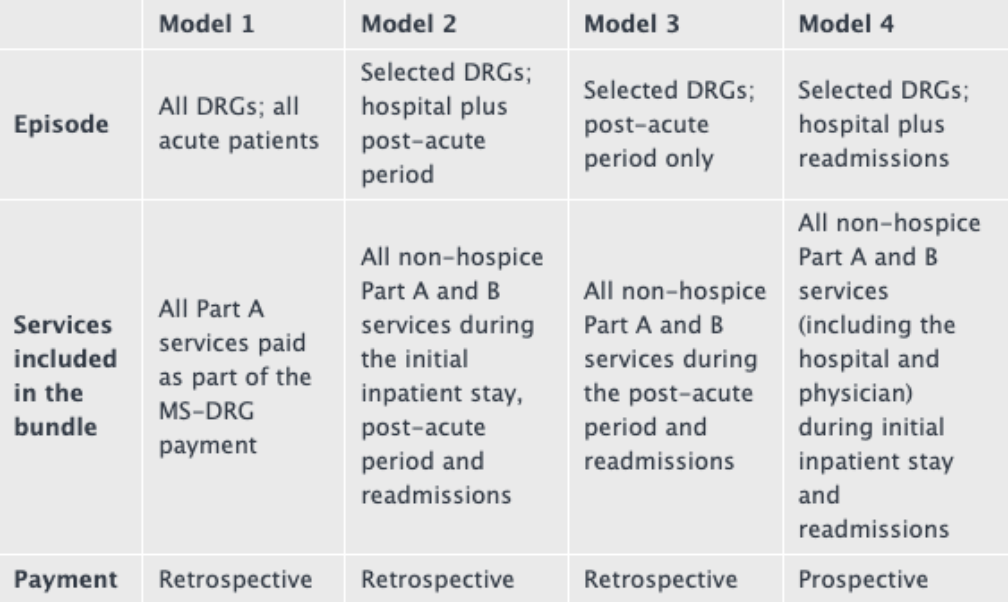

Bundled Payments for Care Improvement Initiative (BPCI) is segregated into four broadly defined care models, which bundle payments for multiple services patients receive during the treatment of care. Healthcare institutions enter into payment arrangements that include financial and performance accountability for an entire treatment of care. These models may provide more coordinated care and may lead to higher quality for patients at a lower cost to Medicare. Usually, Medicare makes individual payments to providers for services they perform for patients during a single illness or course of treatment. This method may result in fragmented care with minimal coordination across providers and healthcare settings. It also rewards the quantity of service offered by physicians rather than the quality of care given. Research has shown that bundled payments can categorize incentives for physicians allowing them to work closely together across all specialties and settings. CMS developed BPCI to test their advanced payment and service models that have the potential to reduce Medicare, Medicaid, or Children’s Health Insurance Program (CHIP) expenditures while preserving or enhancing the quality of care for patients.

Capitation is what Managed Care Organizations (MCOs) use to keep costs under control by placing the financial responsibility of health care delivery on the provider. Physicians control healthcare costs, without becoming frugal on services. Insurance companies and government agencies assess the costs of physician practices based on historical data, comparable prices, and the range of services contracted under the capitation agreement. These payers subsidize physicians in advance, a per-patient fixed amount for a specified period. Physicians earn bonuses and a portion of the capitation payments for providing specific contracted services such as outpatient services, lab tests, health education, routine screenings, counseling services, medication and immunization as well as prevention, diagnosis, and treatment.

In summary, the debate regarding the future of healthcare policy is far from over with APMs remaining intact. APMs will make Medicare more sustainable and private coverage less costly. Physicians across the country have already made significant investments to implement these models, and they are garnering returns, particularly for patients. Now is not the time to walk away from these investments. Instead, we need a productive dialogue on how to make APMs work better for patients and providers to continue to generate the outcomes necessary for a sustainable future in healthcare.